Or, see how a CEO saved $11,000, a Geologist $5,000, a Doctor $9,590, and an Electrician $3,200...

We received an email from Andrew the other day:

"Your research caught my attention because I am paying way above your average most expensive premium! I have an AMP policy which started as an Australian Casualty & Life policy and was put through the blender when AXA took it over mid way. The policy is only for $5,790 per month cover (have stopped escalation) adjusted it to 90 day waiting period a few years ago to reduce premium. Next premium payment is $6,741, due next month. I will be 56. Should I continue with these extortive premiums or do you have a better suggestion?"

Paying too much is the most common income protection mistake in Australia and Andrew was a perfect example of that.

If you have your income protection policy for 5+ years, you're most likely paying 20-30% more than you should. Insurance companies don't reward the loyalty! And in general Income Protection Insurance prices vary by 30-40% among insurance companies in Australia.

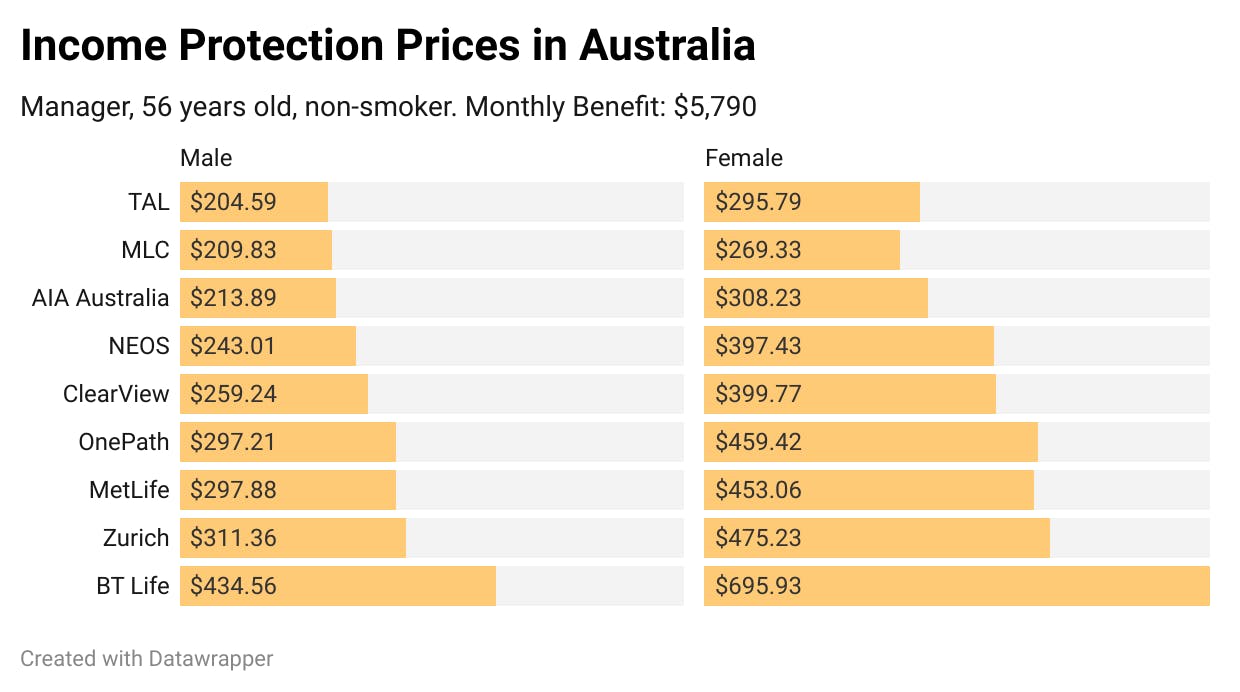

Let’s look at Andrew’s example. For a monthly benefit of $5,790, income protection premiums for a non-smoker range from:

That's a whopping 112% difference or potentially $2759.64 per year wasted! But even the most expensive option is still cheaper than what Andrew was paying.

And just like Andrew, many professionals are unknowingly overspending thousands on premiums. High earners often stand to lose the most through overpriced cover - but also have the most to gain when policies are structured properly. Here are some real examples.

Richard - 60, Male, CEO

Sophie - 55, Female, Geologist

David - 56, Male, Doctor

Hannah - 34, Female, Advertising Executive

Michael - 46, Male, Manager

Lucas - 47, Male, Electrician

See prices from: